|

January 12, 2024 | View Online | Sign Up |

|

|

Victory!

Airbnb sided with us, confirming our innocence and dropping any potential punishment. I celebrated by writing a devastating review…which was removed for breaking impartiality rules.

Apparently, you can't mention frogs when complaining about a French host.

You win some. You lose some.

Let’s get to the points:

Au revoir,

Steven |

|

|

|

|

| CARD OF THE WEEK |

|

|

Note: She convinced me that was a poor and potentially life-threatening decision. She smart. |

|

It’s the Final Countdown…for 90,000 Points |

|

Hello small business owners.* Yes, I’m talking to you. I’ve been watching you the past few months. Passively mulling over my business card recommendations. You’ve not opened one.

And you’ve almost blown it.

Whether it’s apathy, fear, indecision, or good old-fashioned laziness, you’re within a week of losing out on one of the best intro bonuses on the market.

This card has been running an incredible $900 or 90,000-point intro bonus promotion for the past few months. But we’ve received news the offer will be disappearing on January 18 at 9 AM (this coming Thursday).

Per usual, I’m bound by the weird and woeful rules of the banks and can’t name the card, but I can say you’ll only need to spend $6,000 within three months of opening the card. If you have a significant upcoming expense or your monthly outgoings average over $2,000 a month, you’re effectively wasting the chance to earn more than $1,800 in travel if you don’t open the card.

🤔 What’s with the $900/90,000 point thing?

Technically, this card is a cashback product. Used as such, the intro bonus will earn you that $900 I mentioned—pretty good by anyone’s standards. But, combined with a points-earning card from the same issuer, you can convert that $900 bonus into 90,000 points.

Transferring these super-valuable points to an airline or hotel can earn you that $1,800 figure I mentioned above. Here are a few potential ways to redeem those points:

-

Transfer 90,000 points to Virgin Atlantic for a roundtrip business class flight between the US West Coast and Japan on ANA (worth $6,000+).

-

Transfer 90,000 points to Hyatt for 7 nights at a Hyatt Category 3 hotel, such as the Grand Hyatt Atlanta in Buckhead (worth $2,100+).

-

Transfer 90,000 points to British Airways for 12 one-way short-haul flights on American Airlines (worth $1,800+).

-

Transfer 50,000 points to Virgin Atlantic for a one-way flight between the US and Europe in Delta One business class with lie-flat seats (worth $2,000+).

While I was 100% using guilt tactics up top, I’m not exaggerating when I say it’s one of the best intro bonuses I’ve seen in a long time. I’m actually discussing with my partner if she’s in a place to open a new card right now, and this one is at the top of the list.

Learn more here.

*Not sure if you’d qualify? More people are classed as small business owners than you think! |

|

|

|

|

| STEVEN'S TIPS |

|

|

New Year, New Perks

|

|

If you’re anything like me, you’ll already have spent some time building a rough 2024 plan for your points and miles. While nothing is concrete, I always take inventory of my available points and perks to keep them front of mind when plotting my travels.

Here are some things you might want to check before you make any moves.

🎁 Renewed Perks

This is something a lot of us (myself included) forget about. A lot of cards come with annual credits that renew on January 1. Others are tied to your account anniversary. It’s a great idea to check these out and note what’s available for you and when.

For example, if you’re a Capital One Venture X cardholder, you’ll have a $300 hotel statement credit available and 10,000 bonus miles arriving in your account on your card anniversary. Doublecheck the rough dates these should arrive and note them down to help plan.

You could have some new shopping credits that kicked in on January 1 as well. I like to check these out and see if there are any that can genuinely help me. For example, I used to have a $50 Saks 5th Avenue statement credit twice a year. While I never shop there, I’d take inventory of my clothes and what I need to buy, then check the Saks sale page to see if they had what I needed. It was never a huge saving, but $50 is $50.

🤝 Loyalty Perks

If you’re a loyalty program member (especially an elite member), make sure to log into your account and check your status. For some, the New Year could mean a status drop, which could impact your decisions going forward. Others may have the opportunity to pick perks or have additional freebies.

World of Hyatt, for example, threw in five “Guest of Honor” perks for its globalist members, while Platinum or Diamond Medallion Delta members need to pick their individual perks for the year.

🛤️ Loyalty Tracking

If you’re chasing or trying to keep elite status, you’ll also have info on everything you need to do to achieve that goal. Whether you’re a stay or spend-based earner, you’ll have a broad overview of your path to status. Of course, if you’ve earned that status using a card, you don’t have to worry about that. |

|

|

|

|

| TRAVEL INSURANCE |

|

|

The Best Credit Cards for Travel Insurance Benefits |

|

We spend a lot of time writing about the free travel and luxury benefits credit cards can offer you and, trust us, we’ll keep doing that. But there’s one under-appreciated perk flying under the radar of most cardholders, and it might just be the most valuable one of them all: travel insurance.

A strong travel insurance policy should be one of the first things planned before any trip, but it’s often neglected. While we might get away with it most of the time, we’re all a fender bender, missed flight, or lost bag away from an expensive problem. And that’s not even considering some of the worst-case medical scenarios.

So, as you consider a shiny new travel card, keep insurance in mind. To help you find the most valuable, we’ve built a list of the best credit cards for travel insurance benefits. |

|

|

|

|

| SMART POINTS: THE COURSE |

|

|

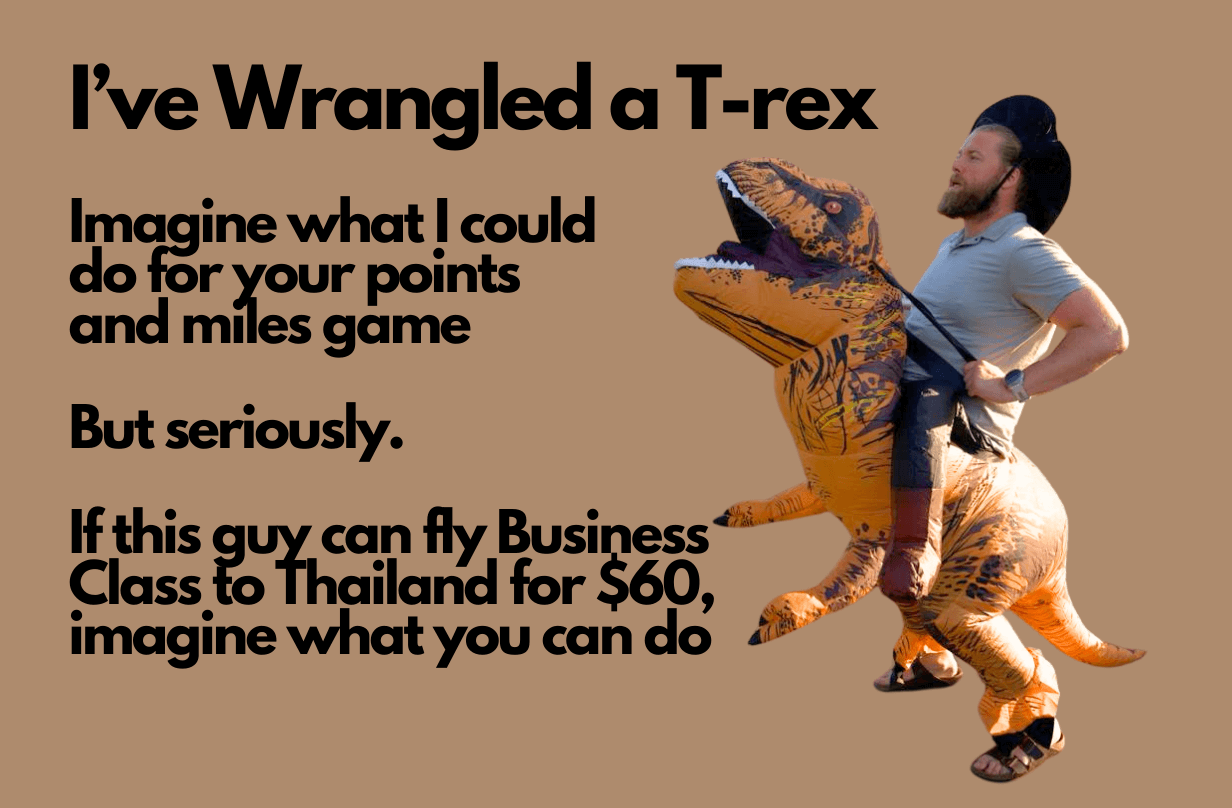

T-Minus 17 Days Until Smart Points: The Course |

|

We’re less than three weeks away from Smart Points: The Course’s official kickoff.

I’m feeling a hectic mixture of excitement and nerves but, above all, I’m buzzing to share everything I’ve been working on over the past few months.

I’ve had a lot of you reaching out with questions about the course, so I thought it’d be helpful to give you some more details here.

✌️ There are two course options

The first option is a live course hosted by me over five days starting on January 29. Each day’s seminar will last about an hour (possibly a little longer–you’ll understand when you see how much I talk) and will cover one aspect of points and miles. If, for some reason, you can’t make one of the days, you’ll get a recording of the whole thing.

Option two is an on-demand course. It’ll cover the same material as the live course and will consist of videos, course notes, and worksheets. The time demands are about the same as the live course–you just have the benefit of doing it at your own pace.

Anyone who does the live course will also get access to the on-demand one, too!

👨🏫 What will I teach you?

In short: everything I know about points and miles. This isn’t a get-points-get-rich scheme. If that’s what you want, don’t sign up. I’m going to dive into everything from the financial preparation required to building an effective strategy to redeeming your miles for maximum value.

If you leave the course with nothing but the name of a few cards to open, I’ve failed. You should be leaving with the skills needed to turn your everyday spending into free travel and keep doing it for a long time.

Feel like taking your travel game up a notch? Learn more about the course here. |

|

|

|

|

| WHAT ELSE IS HAPPENING |

|

*This link is sponsored. |

|

|

|

|